Retirement creates new tax challenges—RMDs, Social Security timing, IRMAA, and investment income that can push you into higher brackets.

Most preparers only report last year.

Most advisors don’t handle taxes at all.

At Sentinel Wealth & Tax, we do both.

We prepare your return and plan ahead so you avoid costly surprises and keep more of your retirement income.

This guide reveals how tax-smart strategies like Roth conversions, QCDs, and income timing can lower Medicare premiums. Sentinel Wealth & Tax helps retirees integrate Medicare planning into their overall financial strategy to reduce costs and protect long-term wealth.

Click the button below to download immediately, no email or contact information is required.

Retirement taxes aren’t simple, and most firms only handle one piece of the puzzle. We integrate tax planning, investment management, and long-term retirement strategy so you avoid costly surprises and keep more of your income each year.

Most tax preparers simply enter numbers into a form and tell you what you owe. There is no strategy, no forward planning, and no coordination with your investments or retirement income. That approach might work during your working years — but it can cost retirees thousands.

We take a different approach. We build a tax plan that looks forward, not backward. Every withdrawal, conversion, and income decision is coordinated to reduce your lifetime tax bill, not just this year’s. That’s the difference between tax filing and tax strategy.

Taxes become more complex once you retire. RMDs, Social Security sequencing, capital gains, and IRMAA brackets can create costly surprises if no one is planning ahead. Most retirees overpay simply because no one is watching the moving parts.

We specialize in helping retirees avoid these pitfalls. With proactive modeling and careful monitoring, we identify issues before they become expensive and keep your tax picture predictable.

Many tax preparers never see your investments, and many advisors never see your tax returns. This disconnect leads to bad timing decisions, avoidable taxes, and missed opportunities. We solve that by bringing both disciplines under one roof.

Because we manage both your portfolio and your tax plan, every trade, withdrawal, and conversion is optimized. Your investments grow more efficiently, and your taxes stay under control—year after year.

Most people focus only on the return they file this April. But your biggest tax opportunities—and risks—often happen years in advance. We project your future brackets, RMDs, IRMAA ranges, and survivor taxes so you’re always prepared.

By planning multiple years ahead, we help you smooth out income, stay in favorable brackets, and protect your spouse or heirs from sudden increases. Predictable planning today creates more financial confidence tomorrow.

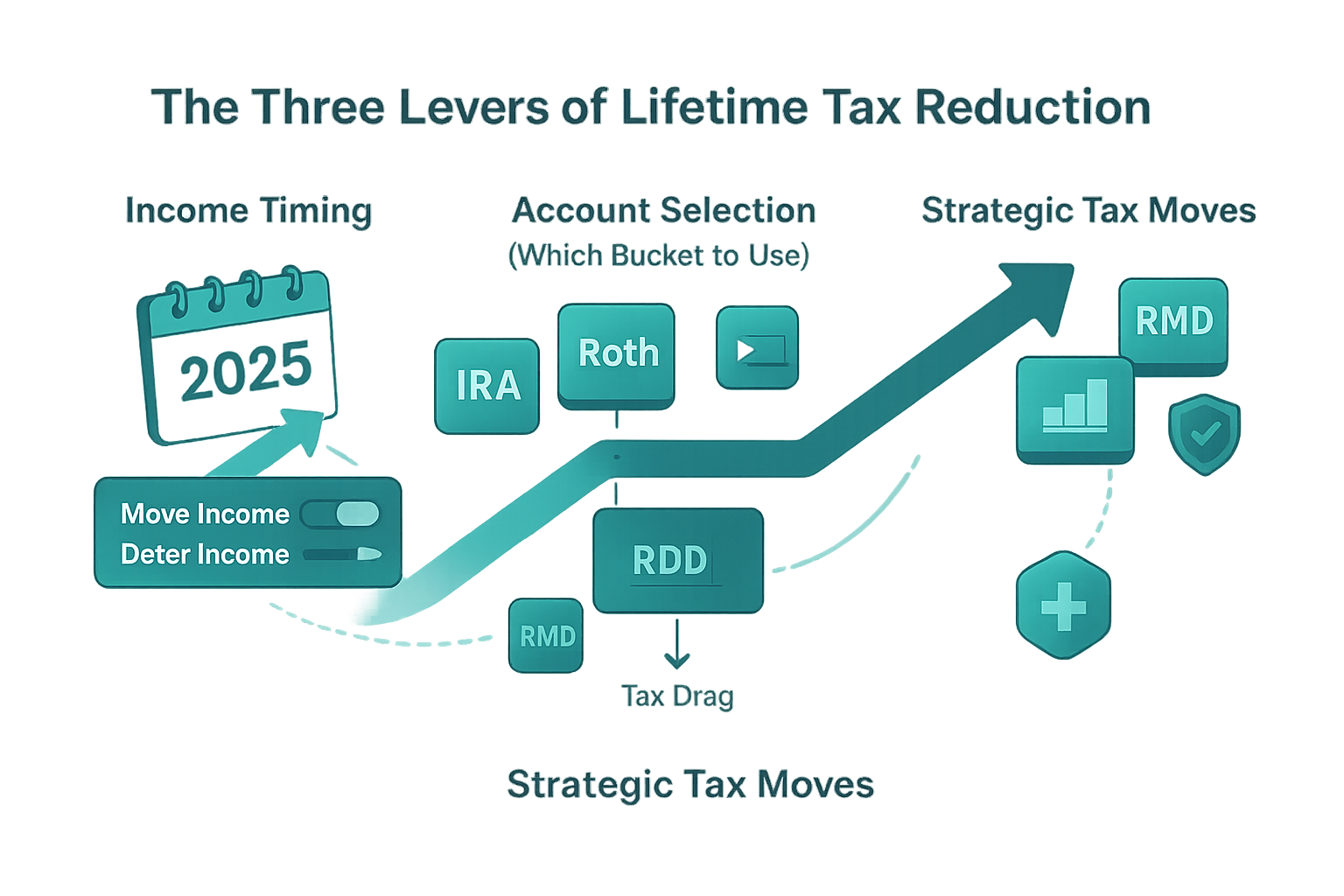

Lowering taxes in retirement isn’t about one decision — it’s about coordinating dozens of small choices over many years. These are the three levers we manage to help reduce your lifetime tax burden and protect more of your retirement income.

Smart tax planning isn’t just about saving money—it’s about creating a secure, predictable, and confident retirement. Here are the real benefits our clients experience when every part of their financial life is planned with taxes in mind.

Effective planning reduces the taxes you pay every year - not just once. By smoothing income, minimizing penalties, and choosing the right withdrawal strategies you can significantly change your tax expense outcomes.

Your retirement income should feel steady, not uncertain. We coordinate your tax plan with your withdrawal strategy so your monthly cash flow remains smooth and reliable.With fewer surprises and more consistency, you can focus on enjoying retirement—not managing it.

Survivor and widow tax rules can sharply increase taxes at the worst possible time. We plan ahead to protect your spouse or family from avoidable tax spikes and ensure a smooth financial transition.Your loved ones are supported with a clear plan that minimizes stress and preserves more of your shared wealth.

Click below to schedule a complimentary meeting with us to hear about what we can do for you

Schedule A Complimentary Meeting.png)